CHÚNG TÔI LÀ AI

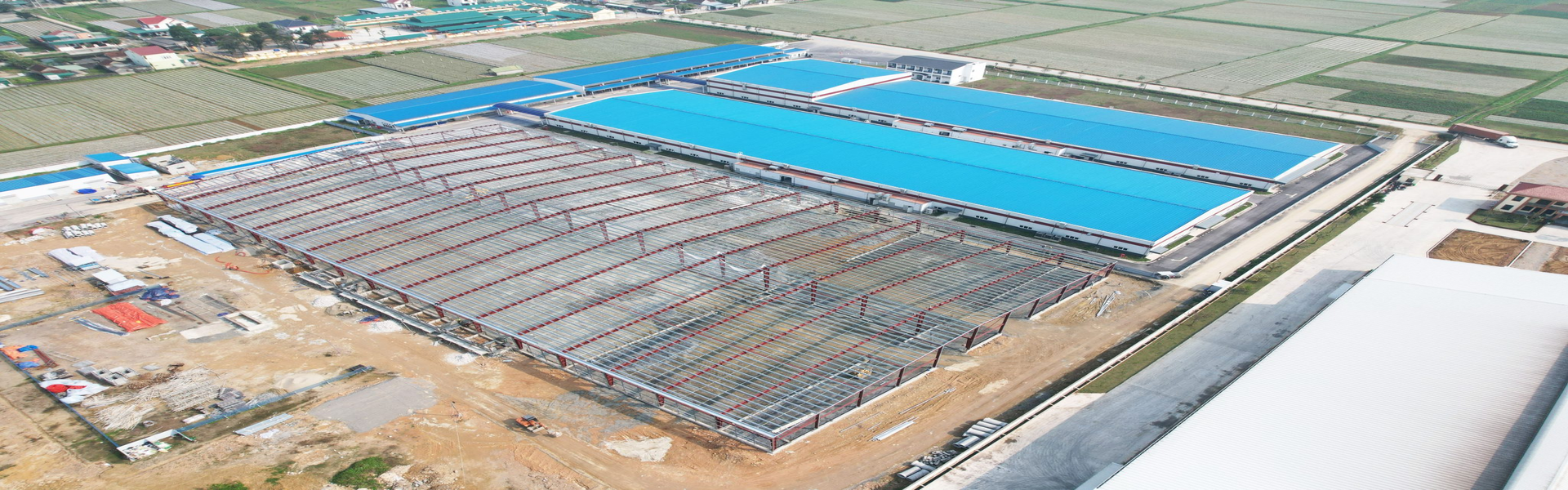

Cung cấp giải pháp kết cấu thép hàng đầu Việt Nam

Lịch sử công ty

Công ty cổ phần đầu tư và xây dựng Việt Nam – VICCO là một doanh nghiệp hoạt động trong lĩnh vực thiết kế, sản xuất, thi công xây dựng dân dụng, công nghiệp. Được thành lập vào những năm đầu của thế kỷ 21, qua 15 hoạt động liên tục không ngừng sáng tạo VICCO tự tin đã trở thành một trong những doanh nghiệp hàng đầu, tiên phong trong lĩnh vực riêng của mình cũng như ngày càng phát triển không ngừng trong ngành xây dựng dân dụng và công nghiệp.

Trong quá trình xây dựng và phát triển VICCO luôn giữ vững một mục tiêu sẽ trở thành một doanh nghiệp hàng đầu việt nam và vươn tầm ra thế giới. Không dừng bước trước mọi khó khăn trong quá trình phát triển, tập thể cán bộ công nhân viên của VICCO luôn lao động miệt mài sáng tạo, kỷ luật trung thực và đầy trách nhiệm đối với mỗi sản phẩm dù là nhỏ nhất [...]

DỊCH VỤ

TƯ VẤN

Tư vấn lập dự án đầu tư xây dựng công trình.

Tư vấn thiết kế kiến trúc công trình dân dụng và công nghiệp.

Tư vấn định giá công trình xây dựng.

Tư vấn lắp đặt thiết bị công trình dân dụng, công nghiệp.

Tư vấn giám sát thi công.

Tư vấn lập quy hoạch các đô thị, các công trình dân dụng và công nghiệp.

THIẾT KẾ

Thiết kế quy hoạch xây dựng.

Thiết kế tổng mặt bằng.

Thiết kế kết cấu công trình xây dựng dân dụng và công nghiệp.

SẢN XUẤT VÀ THI CÔNG

Sản xuất lắp đặt thiết bị kết cấu thép phi tiêu chuẩn.

Sản xuất, lắp đặt các sản phẩm về tôn mái, tôn lợp, tôn bao che các loại.

Cung cấp xà gồ mạ kẽm hoặc sơn màu theo các tiết diện Z, C các loại.

Sản xuất thiết bị nâng hạ.

Sản xuất, kinh doanh các loại cầu trục có trọng tải thiết kế từ 1.0 đến 50 tấn.